Future proof your offering with a secure, scalable and sticky, white label solution that increases revenue

Interested?

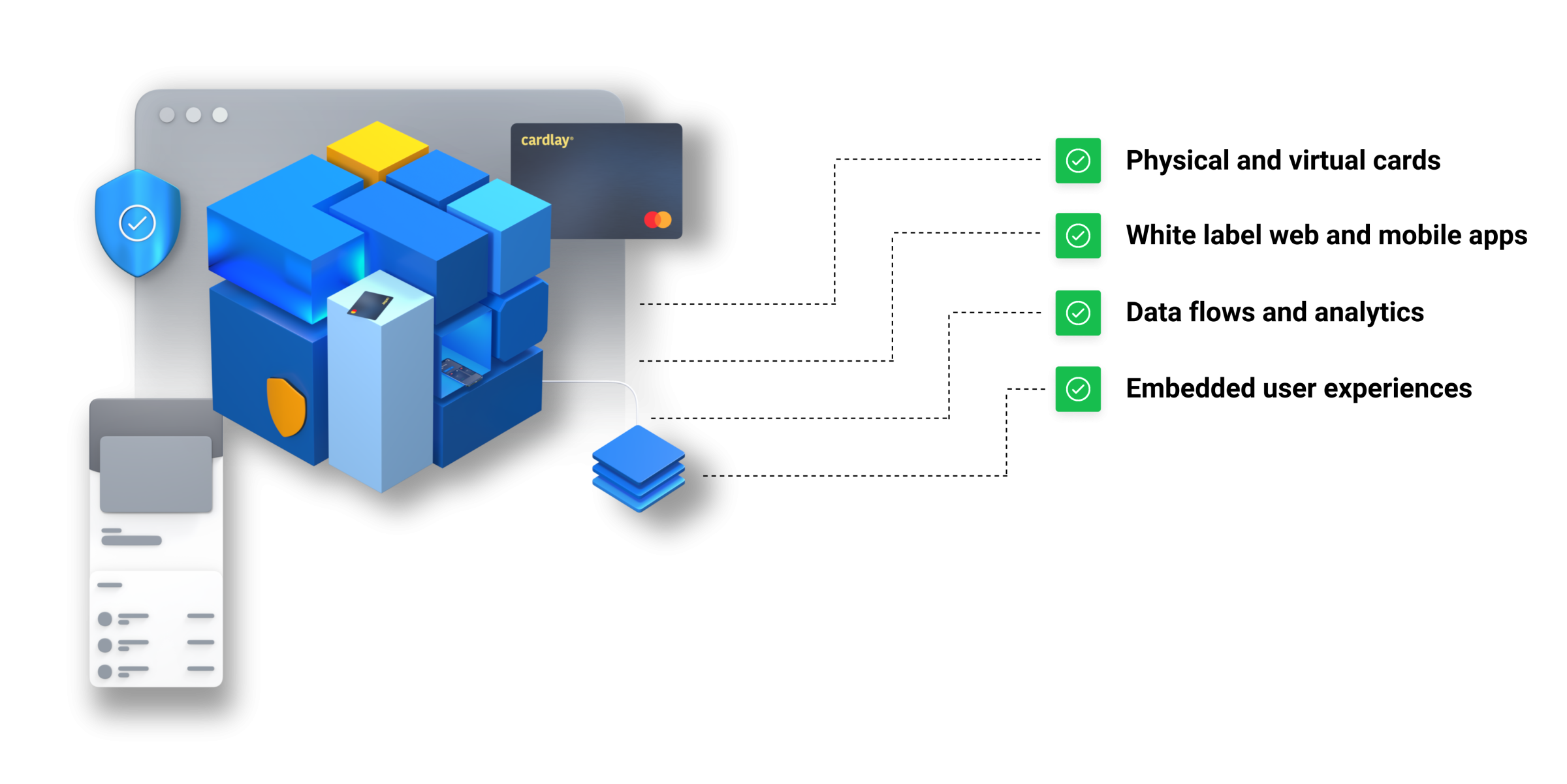

Cardlay’s highly configurable platform allows each partner to set up the platform to meet their needs, without costly and time consuming costumed development. The platform is completely hosted on the AWS fully PCI-DSS compliant cloud infrastructure and maintained according to highest standards.

We are PCI-DSS compliant, ensuring that our applications fully meet your risk and compliance standards.

With a network of issuers across multiple geographies and real-world experience launching white label solutions on different infrastructures, Cardlay is uniquely positioned to support your efforts to expand your card services offering into new markets geographically and further scale your portfolio

Leverage state-of-the-art technology to reduce missed opportunities while delivering a flexible and innovative set of product capabilities to market faster.

Pre-approved issuance of virtual cards on demand facilitates a highly efficient mechanism to put cards in the hands of previously un-carded employees, and eliminates non-authorized payments and inefficient processes such as cash-advances and out-of-pocket expense reimbursement.

Book a demoCustomize your offering

Our modern platform facilitates expanded usage of cards, across more spend categories and geographies, giving your clients greater flexibility in managing their card programs through an unparalleled customer self service capability without losing any of the controls needed to actively manage risk.

Corporate customers need real-time data flows and notifications to enhance usability and streamline the card management and expense reconciliation process. Push notifications, real-time data flows between systems, and embedded control functions ensure the necessary security, transactional transparency, and optimal client experience.

Greater platform flexibility facilitates expanded usage to new classes of previously un-carded employees and across a broader range of possible spend categories, expanding usage volume and increasing revenues, while decreasing costs.

Simplify your client’s expense reporting processes by eliminating of out-of-pocket and cash-advances, while out integrated VAT reclamation process generates incremental value by automating VAT reclaim that is often lost.

Mastercard

SAP Concur

SEB

Eurocard

Citi

Arm yourself with new digital offerings

Grow your expand usage by your existing customer base while protecting your market share from your fintech competitors by providing modern and convenient digital spend management solution, optimizing your internal processes and giving your clients an expanded array of self service capabilities to enhance their experience while reducing your own support costs.

Seamless offering and flexible adaptation

Cardlay’s modular design allows it to be added on top of your digital offerings and integrated into your existing systems leveraging single sign-on with strong authentication for log in, and coherent interfacing between systems.

Stay relevant and secure stickiness

More than just payments, Cardlay’s solution allows you to harness the expanded value proposition of spend management, providing your clients with integrated reconciliation and expense management tools, with the required data flowing directly into their ERP/accounting systems.

Neutral and agnostic

Cardlay’s technology lies embedded on top of your existing backend issuing and processing infrastructure, meaning we can enhance and expand your corporate payment offering regardless of your existing setup.

Solution design and alignment

Workshop with our product and commercial experts Defining your spend management solution mix

Integration & implementation

Partner integration process, product configuration, implementation and customization.

Discovery process

Joint workshops in four streams to uncover the relevant details of your future digital offering 8 weeks process that illuminate all aspects of our future partnership

Market launch and scale

Pilot & PoC. Full market launch. Scale you corporate card portfolio with more card to existing customers and fast onboarding of new ones

Solution design and alignment

Workshop with our product and commercial experts Defining your spend management solution mix

Discovery process

Joint workshops in four streams to uncover the relevant details of your future digital offering 8 weeks process that illuminate all aspects of our future partnership

Integration & implementation

Partner integration process, product configuration, implementation and customization.

Market launch and scale

Pilot & PoC. Full market launch. Scale you corporate card portfolio with more card to existing customers and fast onboarding of new ones

Get full control and visibility into company spending, avoid time-consuming paperwork and make life easier for all your employees.

Control company spending upfront

No subscription or set-up fees

PCI-DSS compliant

Want to get full control and visibility into company spending, avoid time-consuming paperwork and make life easier for all your employees? Book a demo now

Control company spending upfront

No subscription or set-up fees

PCI-DSS compliant